Analysing AI Tokens: Handling Bearish Trends and Watching for a Possible Reversal Overview

Market mood may change quickly in the volatile realm of cryptocurrencies due to a variety of reasons, including investor behaviour, technical breakthroughs, and market trends. AI Token ($AI) is one token that has recently attracted a lot of interest. As of right now, $AI is not showing much promise because it is getting close to a critical support level of $0.44 amid ongoing negative trends. There is, perhaps, a bright side to this situation. We will examine $AI’s current situation, the possibility of a market reversal, and how $AI may lead $FET in the next cycle’s bull rise in this post.

The Situation of $AI Right Now

Right now, $AI is going through a difficult time. The token has been trending down, progressively losing value as it moves closer to the crucial $0.44 support level. This support level is important because it denotes a price at which buyers have intervened in the past to stop further losses. Should $AI maintain this level of support, this may indicate that a reversal is imminent. There are several reasons for the negative tendencies observed in $AI:

1. industry Sentiment: Investors are generally apprehensive about possible downturns in the bitcoin industry.

2. Regulatory Concerns: Investor hesitancy has been impacted by ongoing regulatory scrutiny and uncertainty, which has negatively impacted the performance of other cryptocurrencies, including $AI.

3. Technical Indicators: $AI has been trading regularly below important moving averages, which is a negative indication, according to technical analysis. Possibility of Reversal There are grounds to think that $AI could be about to reverse, even with the negative patterns that are now in place.

A number of factors point to the possibility of an impending trend change: Support Level at $0.44: It’s important to maintain the $0.44 support level.

1. In the past, support levels have frequently served as a floor for the price, where buying pressure exceeds selling pressure and a possible reversal occurs.

2. Oversold Conditions: The Relative Strength Index (RSI) and other technical indicators suggest that $AI may be in oversold conditions. This can draw in purchasers searching for deals that are undervalued.

3. Market Cycles: The movement of cryptocurrencies is frequently cyclical. It’s possible that the present slump is a component of a longer cycle, and that when market circumstances improve, there will be an upturn.

The Following Bull Rally

It may be in a position to spearhead the upcoming bull rally if $AI is able to maintain the $0.44 support and breaks out from its present downward trend. In the past, $AI has proven to be able to bounce back from negative markets and give investors significant gains. We’ve seen in earlier situations that $AI has made up to 90% profit in bullish cycles. While previous performance does not guarantee future outcomes, it does offer some insight into the potential benefits of artificial intelligence.

Important Things to Keep an Eye on

Future $AI performance will be influenced by a number of important elements as we negotiate the present market conditions, including:

1. Technological Advancements: It will be essential to keep up the innovation and development in the blockchain and artificial intelligence fields. Any noteworthy developments might pique investor attention and increase $AI’s value.

2. Market Sentiment: It’s critical to keep an eye on the general attitude of the bitcoin market. An rise in institutional interest, positive news, or clear regulations might serve as triggers for a market turnaround.

3. Macroeconomic Factors: The development of $AI and the larger cryptocurrency market will also be influenced by broader economic factors such as interest rates, inflation rates, and worldwide economic stability.

Conclusion

Even if there are negative tendencies at the moment and $AI is getting close to a crucial support level of $0.44, there are still reasons to be cautiously hopeful. Technical indications, larger market cycles, and historical trends all point to the possibility of a market reversal. Given that $FET and $AI have the ability to lead the next bull market rise together, investors should closely monitor important support levels, market mood, and technical developments. Investors may position themselves to take advantage of possible opportunities in the rapidly changing cryptocurrency ecosystem by remaining watchful and knowledgeable. In conclusion, $AI’s path is one of possibility and resiliency. For those prepared to work through the intricacies of the cryptocurrency market, there remains a bright future ahead, even in spite of the present difficulties. This is the prospect of a reversal and following bull rise.

You may also like

Convert Generation IT LLC Now Operating in the USA

Freelancing SEO Services on Fiverr to Make Sites Visible

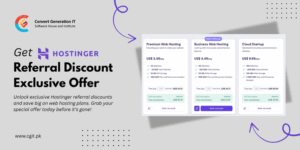

Get Hostinger Referral Discount – Exclusive Offer